中文

中文

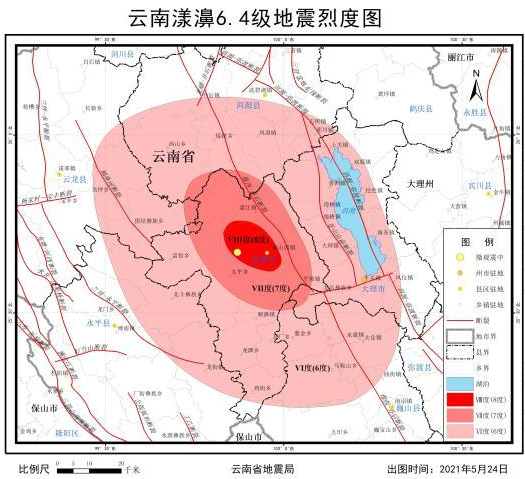

At 21:48 on 21 May, a 6.4 magnitude earthquake hit Yangbi County, Dali Prefecture, Yunnan. As the lead reinsurer and the chief project designer of the local government earthquake-triggered farmer’s house index insurance in Dali (the “Policy Farmer’s House Earthquake Insurance”), China Re P&C, a subsidiary of China Re Group, immediately contacted its clients to express its utmost concern for the disaster and its willingness to provide follow-up services. Within 22 hours after the earthquake, the first claim of the Dali Prefecture Earthquake Index Insurance amounting to RMB40 million was settled, and the reinsurer’s liability exceeded RMB20 million. The timely claim settlement has strongly supported earthquake relief, guaranteed the basic living of those affected and the post-disaster recovery and reconstruction, which is an important reflection of “ensuring stability on the six fronts and security in the six areas” to safeguard the bottom line of people’s livelihood.

The pilot project of the Policy Farmer’s House Earthquake Insurance in Dali Prefecture, Yunnan Province was officially launched in August 2015. The project is the first “index-type catastrophe insurance” in China, pursuant to which, once the claim conditions are triggered, the amount of claims can be assessed according to the disaster index specified in the policy and the payment of such compensation can be made directly without on-site inspection to assess the losses. This can greatly save time in disaster relief, help improve efficiency of disaster relief and promote the reconstruction and production resumption of post-disaster public facilities. As the lead reinsurer of the project, China Re P&C actively cooperated with governments at all levels, regulatory authorities and other insurers to provide important technical assistance such as seismic risk actuarial analysis and product design as well as sufficient reinsurance underwriting capacity. In six years of operation, the Company provided reinsurance risk coverage of RMB671 million, accounting for more than 30% of the accumulated risk coverage of the primary insurance business.

Improving the ability to respond to catastrophe, public security emergencies and health incidents, and improving social governance and risk resistance are the focus of the insurance industry to better serve the policy of “ensuring stability in the six fronts and security in the six areas”. Adhering to the strategy of innovation and serving the community and people’s livelihood, China Re P&C continuously expanded the cooperation in the area of catastrophe and jointly participated in promoting the development of China’s pilot projects of catastrophe insurance. At present, there are pilot projects of catastrophe insurance in 16 counties, cities and provinces of China. Among which, China Re P&C has served as the lead reinsurer of over 80% of the projects, providing more than RMB5.8 billion of catastrophe risk coverage including typhoons, earthquakes and floods for urban and rural residents of the earthquake co-protection system in provinces and cities such as Guangdong, Hubei, Sichuan and Yunnan. This gives full play to the role of the national reinsurer in serving the national disaster management system and in the development of social governance system.

China Re P&C will continue to actively participate in the development of China’s catastrophe insurance system, deeply promote the local catastrophe insurance pilot projects, and solidly push ahead the implementation of the policy of “ensuring stability in the six fronts and security in the six areas” so as to make contributions to the innovative development of catastrophe insurance and the development of the national disaster governance system.